python马丁策略 python实现马丁策略的实例详解

达科索斯 人气:0马丁策略本来是一种赌博方法,但在投资界应用也很广泛,不过对于投资者来说马丁策略过于简单,所以本文将其改进并使得其在震荡市中获利,以下说明如何实现马丁策略。

策略

逢跌加仓,间隔由自己决定,每次加仓是当前仓位的一倍。

连续跌两次卖出,且卖出一半仓位。

如果爆仓则全仓卖出止损。

初始持仓设置为10%~25%,则可进行2到3次补仓。

初始化马丁策略类属性

def __init__(self,startcash, start, end): self.cash = startcash #初始化现金 self.hold = 0 #初始化持仓金额 self.holdper = self.hold /startcash #初始化仓位 self.log = [] #初始化日志 self.cost = 0 #成本价 self.stock_num = 0 #股票数量 self.starttime = start #起始时间 self.endtime = end #终止时间 self.quantlog = [] #交易量记录 self.earn = [] #总资产记录 self.num_log = [] self.droplog = [0]

为了记录每次买卖仓位的变化初始化了各种列表。

交易函数

首先导入需要的模块

import pandas as pd import numpy as np import tushare as ts import matplotlib.pyplot as plt

def buy(self, currentprice, count):

self.cash -= currentprice*count

self.log.append('buy')

self.hold += currentprice*count

self.holdper = self.hold / (self.cash+ self.hold)

self.stock_num += count

self.cost = self.hold / self.stock_num

self.quantlog.append(count//100)

print('买入价:%.2f,手数:%d,现在成本价:%.2f,现在持仓:%.2f,现在筹码:%d' %(currentprice ,count//100, self.cost, self.holdper, self.stock_num//100))

self.earn.append(self.cash+ currentprice*self.stock_num)

self.num_log.append(self.stock_num)

self.droplog = [0]

def sell(self, currentprice, count):

self.cash += currentprice*count

self.stock_num -= count

self.log.append('sell')

self.hold = self.stock_num*self.cost

self.holdper = self.hold / (self.cash + self.hold)

#self.cost = self.hold / self.stock_num

print('卖出价:%.2f,手数:%d,现在成本价:%.2f,现在持仓:%.2f,现在筹码:%d' %(currentprice ,count//100, self.cost, self.holdper, self.stock_num//100))

self.quantlog.append(count//100)

self.earn.append(self.cash+ currentprice*self.stock_num)

self.num_log.append(self.stock_num)

def holdstock(self,currentprice):

self.log.append('hold')

#print('持有,现在仓位为:%.2f。现在成本:%.2f' %(self.holdper,self.cost))

self.quantlog.append(0)

self.earn.append(self.cash+ currentprice*self.stock_num)

self.num_log.append(self.stock_num)

持仓成本的计算方式是利用总持仓金额除以总手数,卖出时不改变持仓成本。持有则是不做任何操作只记录日志

数据接口

def get_stock(self, code): df=ts.get_k_data(code,autype='qfq',start= self.starttime ,end= self.endtime) df.index=pd.to_datetime(df.date) df=df[['open','high','low','close','volume']] return df

数据接口使用tushare,也可使用pro接口,到官网注册领取token。

token = '输入你的token' pro = ts.pro_api() ts.set_token(token) def get_stock_pro(self, code): code = code + '.SH' df = pro.daily(ts_code= code, start_date = self.starttime, end_date= self.endtime) return df

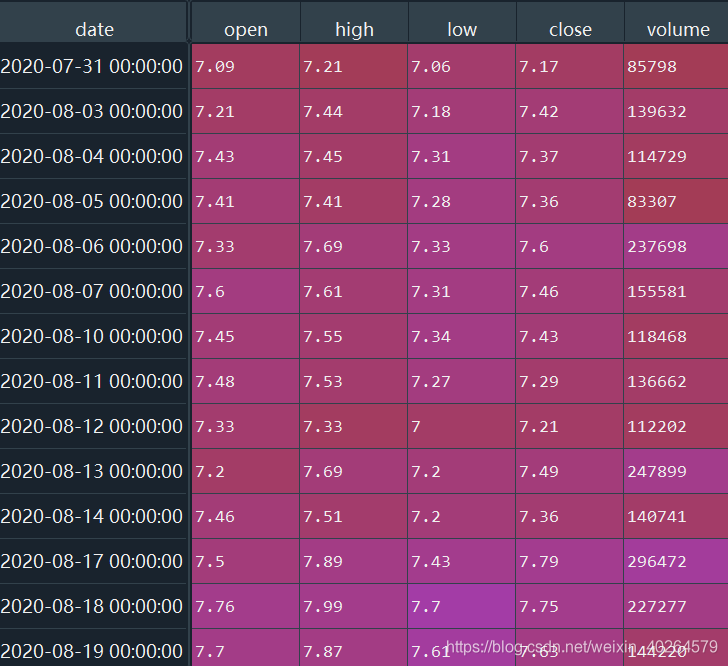

数据结构:

回测函数

def startback(self, data, everyChange, accDropday):

"""

回测函数

"""

for i in range(len(data)):

if i < 1:

continue

if i < accDropday:

drop = backtesting.accumulateVar(everyChange, i, i)

#print('现在累计涨跌幅度为:%.2f'%(drop))

self.martin(data[i], data[i-1], drop, everyChange,i)

elif i < len(data)-2:

drop = backtesting.accumulateVar(everyChange, i, accDropday)

#print('现在累计涨跌幅度为:%.2f'%(drop))

self.martin(data[i],data[i-1], drop, everyChange,i)

else:

if self.stock_num > 0:

self.sell(data[-1],self.stock_num)

else: self.holdstock(data[i])

因为要计算每日涨跌幅,要计算差分,所以第一天的数据不能计算在for循环中跳过,accDropday是累计跌幅的最大计算天数,用来控制入场,当累计跌幅大于某个数值且仓位为0%时可再次入场。以下是入场函数:

def enter(self, currentprice,ex_price,accuDrop):

if accuDrop < -0.01:#and ex_price > currentprice:

count = (self.cash+self.hold) *0.24 // currentprice //100 * 100

print('再次入场')

self.buy(currentprice, count)

else: self.holdstock(currentprice)

入场仓位选择0.24则可进行两次抄底,如果抄底间隔为7%可承受最大跌幅为14%。

策略函数

def martin(self, currentprice, ex_price, accuDrop,everyChange,i):

diff = (ex_price - currentprice)/ex_price

self.droplog.append(diff)

if sum(self.droplog) <= 0:

self.droplog = [0]

if self.stock_num//100 > 1:

if sum(self.droplog) >= 0.04:

if self.holdper*2 < 0.24:

count =(self.cash+self.hold) *(0.25-self.holdper) // currentprice //100 * 100

self.buy(currentprice, count)

elif self.holdper*2 < 1 and (self.hold/currentprice)//100 *100 > 0 and backtesting.computeCon(self.log) < 5:

self.buy(currentprice, (self.hold/currentprice)//100 *100)

else: self.sell(currentprice, self.stock_num//100 *100);print('及时止损')

elif (everyChange[i-2] < 0 and everyChange[i-1] <0 and self.cost < currentprice):# or (everyChange[i-1] < -0.04 and self.cost < currentprice):

if (self.stock_num > 0) and ((self.stock_num*(1/2)//100*100) > 0):

self.sell(currentprice, self.stock_num*(1/2)//100*100 )

#print("现在累计涨跌幅为: %.3f" %(accuDrop))

elif self.stock_num == 100: self.sell(currentprice, 100)

else: self.holdstock(currentprice)

else: self.holdstock(currentprice)

else: self.enter(currentprice,ex_price,accuDrop)

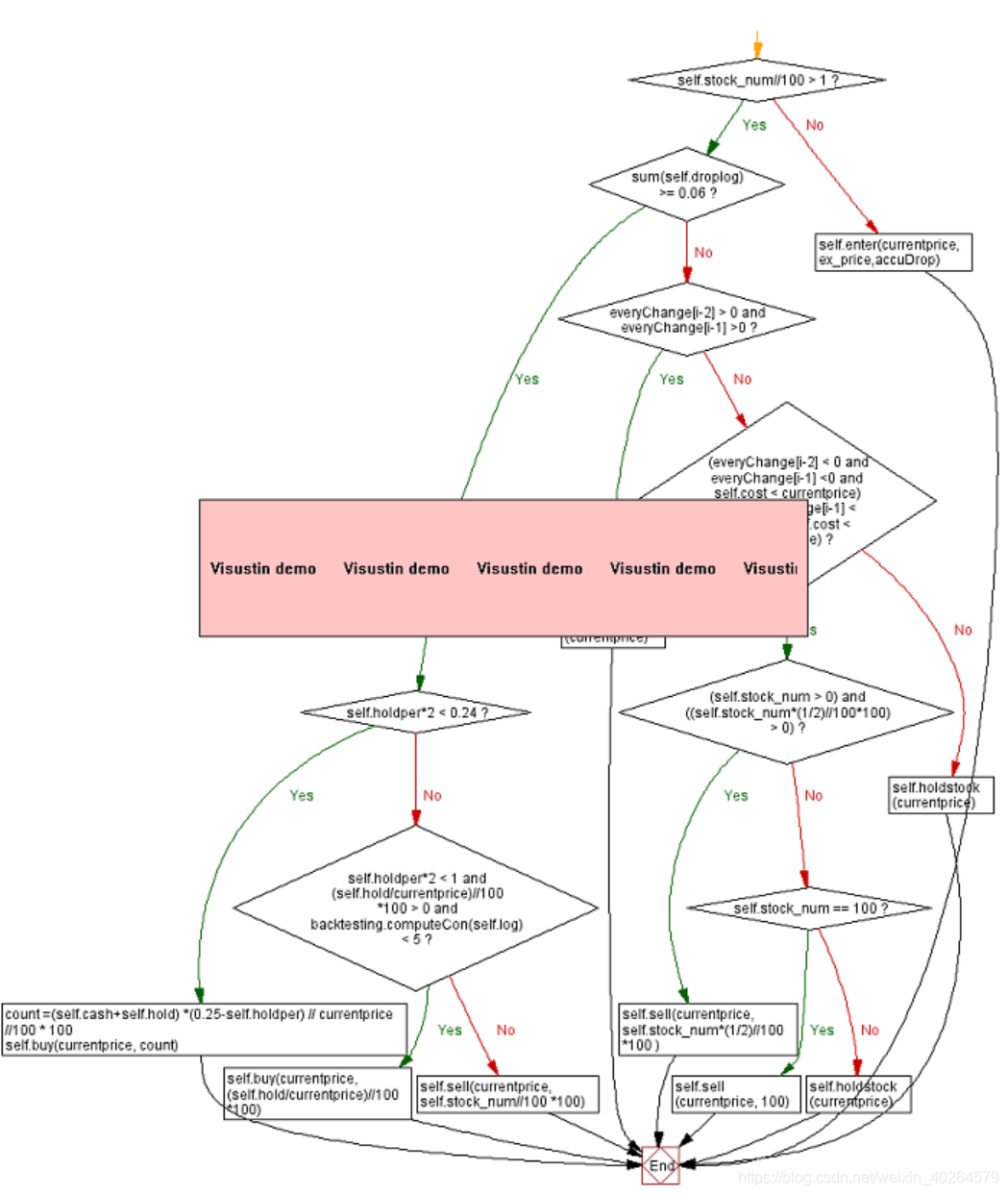

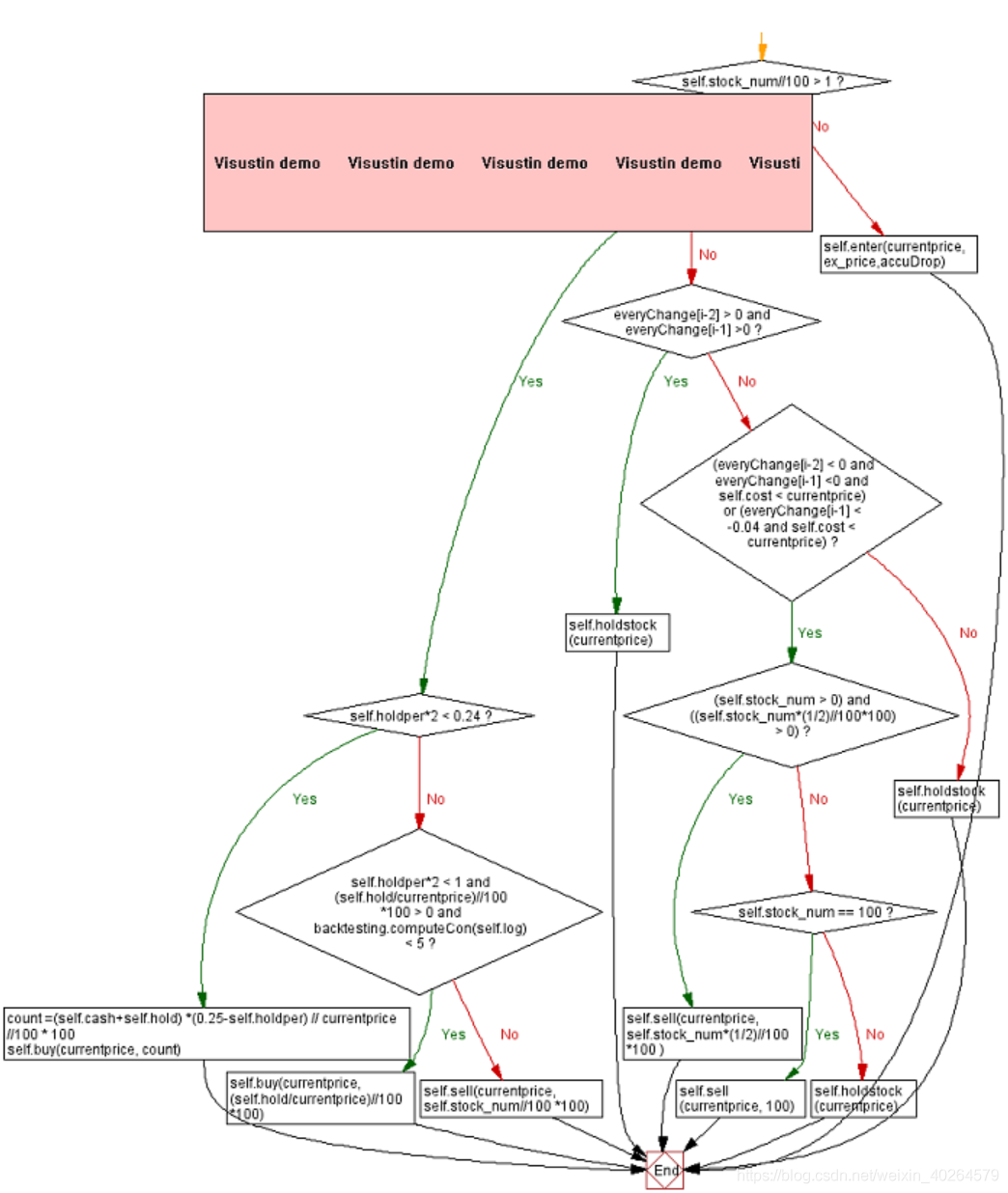

首先构建了droplog专门用于计算累计涨跌幅,当其大于0时重置为0,每次购买后也将其重置为0。当跌幅大于0.04则买入,一下为流程图(因为作图软件Visustin为试用版所以有水印,两个图可以结合来看):

此策略函数可以改成其他策略甚至是反马丁,因为交易函数可以通用。

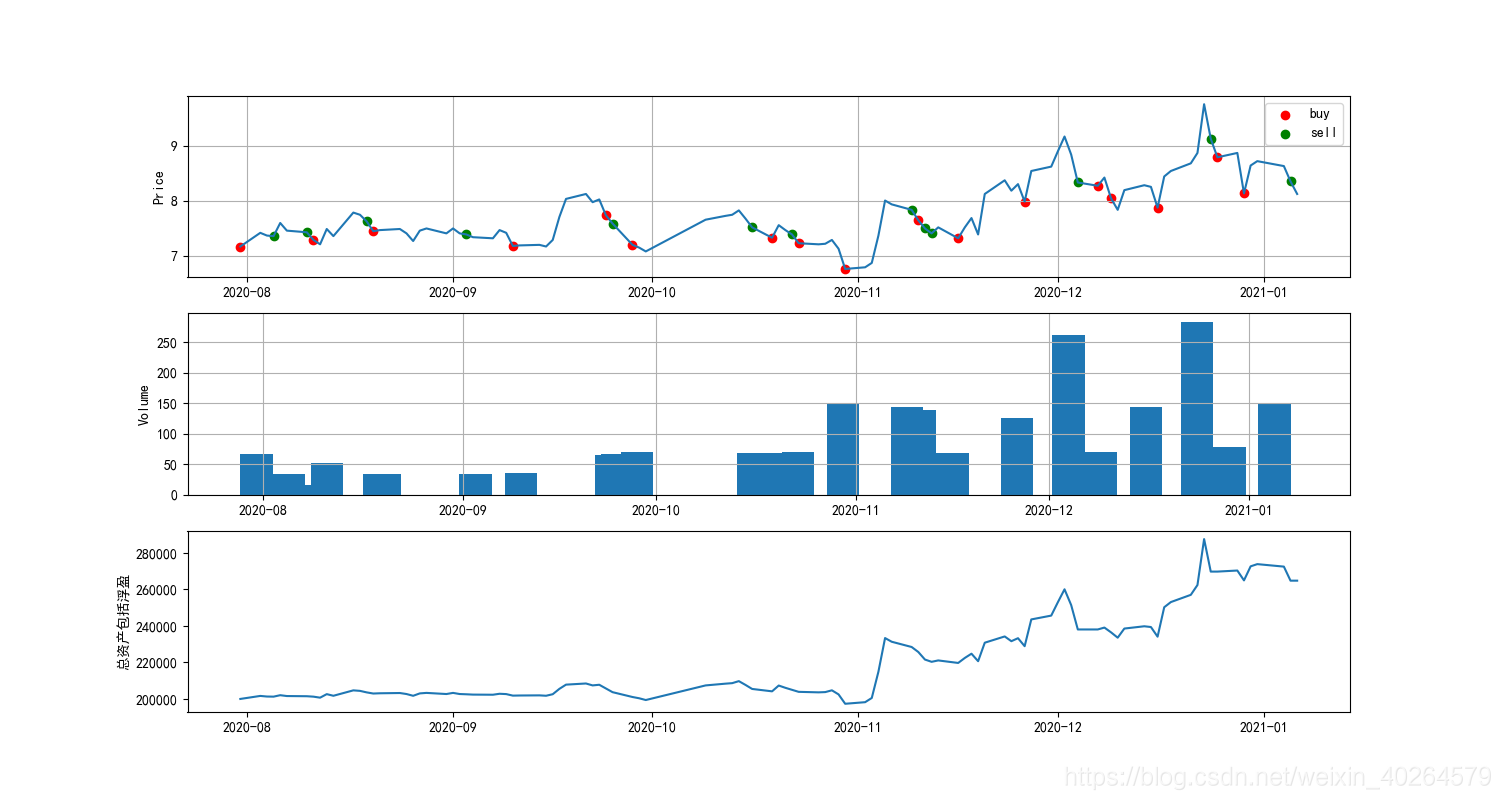

作图和输出结果

buylog = pd.Series(broker.log)

close = data.copy()

buy = np.zeros(len(close))

sell = np.zeros(len(close))

for i in range(len(buylog)):

if buylog[i] == 'buy':

buy[i] = close[i]

elif buylog[i] == 'sell':

sell[i] = close[i]

buy = pd.Series(buy)

sell = pd.Series(sell)

buy.index = close.index

sell.index = close.index

quantlog = pd.Series(broker.quantlog)

quantlog.index = close.index

earn = pd.Series(broker.earn)

earn.index = close.index

buy = buy.loc[buy > 0]

sell = sell.loc[sell>0]

plt.plot(close)

plt.scatter(buy.index,buy,label = 'buy')

plt.scatter(sell.index,sell, label = 'sell')

plt.title('马丁策略')

plt.legend()

#画图

plt.rcParams['font.sans-serif'] = ['SimHei']

fig, (ax1, ax2, ax3) = plt.subplots(3,figsize=(15,8))

ax1.plot(close)

ax1.scatter(buy.index,buy,label = 'buy',color = 'red')

ax1.scatter(sell.index,sell, label = 'sell',color = 'green')

ax1.set_ylabel('Price')

ax1.grid(True)

ax1.legend()

ax1.xaxis_date()

ax2.bar(quantlog.index, quantlog, width = 5)

ax2.set_ylabel('Volume')

ax2.xaxis_date()

ax2.grid(True)

ax3.xaxis_date()

ax3.plot(earn)

ax3.set_ylabel('总资产包括浮盈')

plt.show()

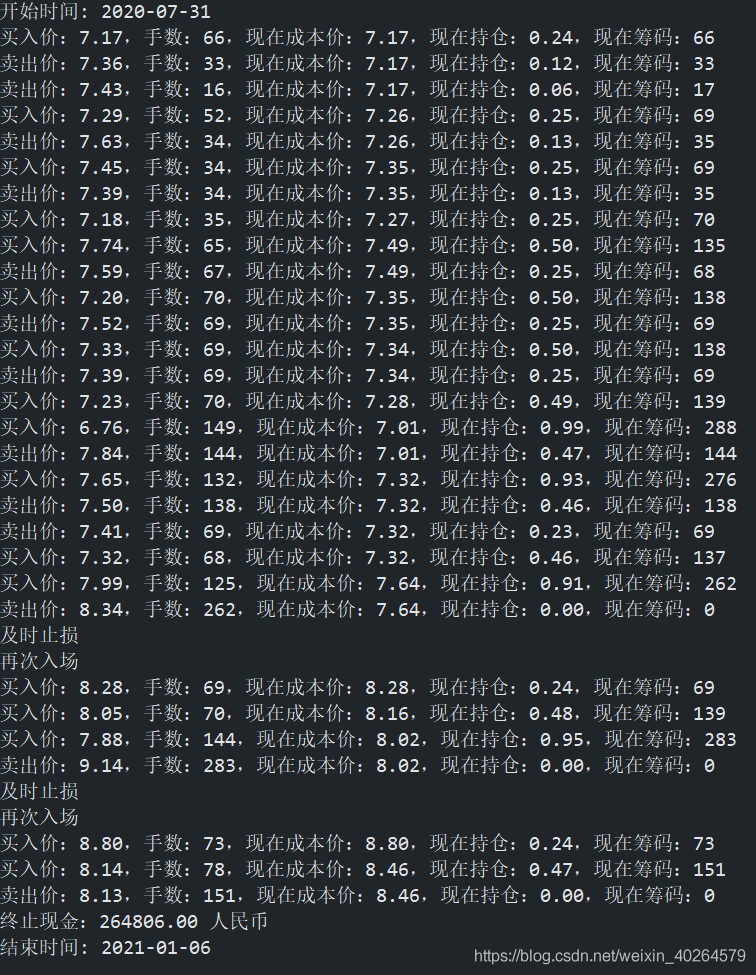

交易日志

加载全部内容